Are you feeling stuck when it comes to choosing between a career in consulting and one in investment banking?

You're not alone!

Many professionals find themselves in a similar situation, not knowing which path to take. Both consulting and investment banking offer great opportunities for growth, but they have their own unique challenges and rewards.

Consulting Vs. Investment Banking

When it comes to consulting, involves working closely with various companies and organizations to offer expert advice and solutions to their problems. Consultants often tackle diverse projects, from strategy development to process optimization, providing fresh perspectives and innovative ideas.

They are often brought in to analyze current practices, identify areas for improvement, and implement effective solutions. The consulting industry offers a dynamic and intellectually stimulating environment, allowing professionals to work on diverse projects and continuously learn from different experiences.

On the other hand, investment banking revolves around the financial world, where professionals help companies and governments raise capital through the issuance of stocks and bonds, as well as advising on mergers and acquisitions. Investment bankers work with corporations, governments, and other entities to help them raise capital by issuing stocks or bonds. Professionals in this field often work long hours to execute complex deals and must have a keen eye for detail to navigate the intricacies of the financial markets.

In this blog, we'll explore the main differences between these two career options and help you make an informed decision. So, let's dive in.

An Overview

Although both consulting and investment banking can be quite complementary careers, the skills they develop can be quite different.

Consulting has “a focus on general problem solving and thinking about why a business should do something and how to convince a client to actually do it."

Investment banking, meanwhile, is more focused, and it’s expected that you’ll develop expert knowledge on valuation methods, financial modeling, and transactions—and how to apply these practically.

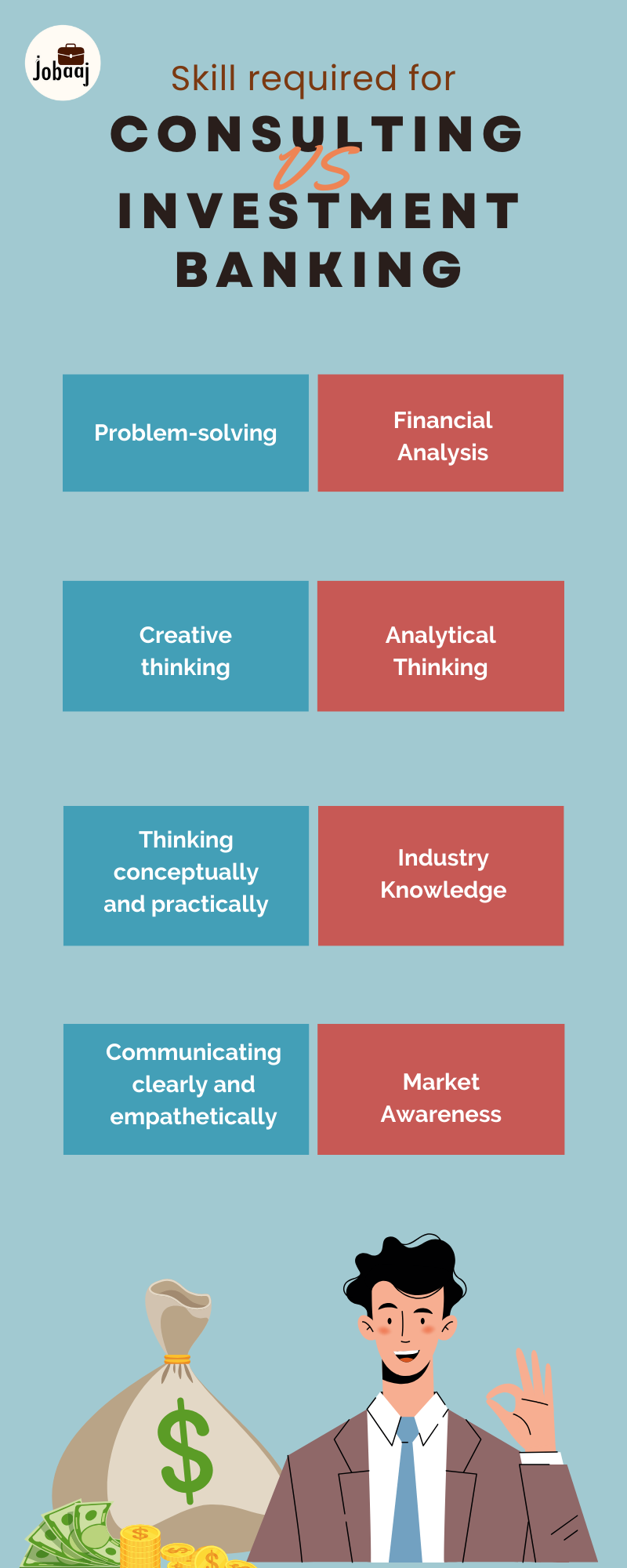

Skills you require:

Consultant

As a consultant, your daily activities involve data gathering, strategy formulation, and presenting plans to businesses. The essential skills for these tasks are stated below:

Problem-solving:

The aptitude to identify problems, analyze root causes, and devise effective solutions to overcome obstacles and achieve desired outcomes.

Creative thinking:

The ability to generate innovative and original ideas, solutions, and approaches to tackle challenges and find opportunities beyond conventional methods.

Thinking conceptually and practically:

Being able to understand complex concepts and theories while also translating them into practical, actionable plans and strategies.

Communicating clearly and empathetically:

The skill of expressing ideas, information, and feedback in a concise and understandable manner, while also considering the feelings and perspectives of others.

Credibility:

Building trust and reliability through consistent and ethical behavior, professional expertise, and delivering high-quality work.

Collaboration with all job levels:

The capacity to work effectively with colleagues, superiors, and subordinates fosters teamwork and synergy across different hierarchical levels in an organization.

Organization and time management:

The ability to organize tasks, set priorities, and efficiently manage time to meet deadlines and maintain productivity.

Curiosity:

Having a strong desire to explore, learn, and seek new information fuels continuous improvement and adaptability.

Investment Banking

A career in investment banking demands a diverse set of skills to thrive in this fast-paced and competitive industry.

Financial Analysis:

Strong proficiency in financial analysis is essential. Investment bankers need to analyze financial statements, assess company performance, and evaluate investment opportunities Must be able to compute valuations, modeling, and forecasting, such as DCF, CAGR, Equity Valuation, WACC, CCA, etc

Analytical Thinking:

Investment bankers must think critically and solve intricate financial problems. They need to quickly identify key drivers, risks, and potential opportunities in transactions.

Industry Knowledge:

A deep understanding of various industries and their market dynamics is important for identifying potential deals and advising clients effectively.

Market Awareness:

Staying up-to-date with the financial markets and economic trends is vital for investment bankers.

Recruitment Process:

The consultant recruitment process can vary from firm to firm, but there are some common steps that most firms follow.

The first step is typically an online application. This application will ask for your basic information, such as your education, work experience, and skills. You may also be asked to answer some questions about your motivation for becoming a consultant and your strengths and weaknesses.

After your application is reviewed, you may be invited to a first round of interviews. These interviews will typically be conducted by a recruiter or a junior consultant. They will ask you questions about your background, your experience, and your fit for the firm.

If you are successful in the first round of interviews, you may be invited to a case interview. A case interview is a simulation of a real-world consulting problem. You will be given a set of information and asked to come up with a solution. The case interview is designed to test your analytical and problem-solving skills.

After the case interview, you may be invited to a final round of interviews. These interviews will typically be conducted by partners or senior consultants. They will ask you more in-depth questions about your skills, your experience, and your goals.

If you are successful in the final round of interviews, you will be offered a job.

Salary Offered:

According to AmbitionBox, the average salary for a consultant in India is 10.5 lakhs per year. This can range from 5.6 lakhs per year for an entry-level consultant to 21 lakhs per year for a senior consultant.

The average salary for an investment banker in India is 17.9 lakhs per year. This can range from 11.5 lakhs per year for an entry-level investment banker to 40 lakhs per year for a senior investment banker.

Factors that can affect the salary in India

| Factors | Consultant | Investment Banker |

| Firm | Salary varies depending on the consulting firm; big-name firms may offer higher salaries. | Big-name investment banks typically offer higher salaries compared to boutique firms. |

| Location | Consultants in major cities like Mumbai and Bangalore may earn more due to higher living costs and the demand for consulting services. | Investment bankers in major financial hubs like Mumbai, Bangalore, and Delhi may earn higher salaries due to the concentration of financial institutions. |

| Experience | Senior consultants with significant experience may command higher salaries, but the salary range is typically lower compared to investment bankers at the same level. | Investment bankers with more experience generally earn higher salaries, especially at the senior levels where bonuses and incentives are substantial. |

| Skills | Specialized consulting skills such as strategy development, process optimization, and industry expertise may command higher salaries. | Investment bankers with specialized skills in areas like mergers and acquisitions (M&A) or financial modeling may earn higher salaries due to their expertise. |

| Work Hours | Consultants typically work 40–60 hours per week, with occasional longer hours depending on project deadlines. | Investment bankers often work longer hours, ranging from 60-100+ hours per week, especially during deal closings and busy periods. |

| Exit Opportunities | Consultants have a broader range of exit opportunities, including senior executive roles in various industries or starting their own businesses. | Investment bankers often transition to roles in private equity, hedge funds, corporate finance, or senior leadership positions in finance-related industries. |